The world where we live in is powered by technologies and digitalization. Due to this, the consumers are getting more and more dependent on smartphones thus making it part of their day-to-day life.

Smartphone usage is not only limited to the entertainment segment or social media but is being used vigorously to buy and sell everything including the Grocery, Booking tickets, and many more. All this can be done with just a few taps on your mobile phone devices thus making easy accessibility of goods and services.

As the Society is going Cashless the digital wallets have become the talk of the town. The people are using the digital wallet solution in everything, be it paying bills, shopping, eating in restaurants, and more hence making Digital wallet payments as the major contributor to fintech growth in the world.

What is an E-Wallet?

An E-Wallet payment system is that financial instrument which allows business and individuals to receive and send money via mobile devices.

It is a type of digital currency for online transactions which is being referred to as the program which allows the user to store and use electronic money.

The E-wallet or the digital payment system is a password-protected account for storing the money for online transactions.

The payment would not be completed unless the One-time password received on the user’s phone is being checked and entered by the user on the e-wallet application. This digital system is being connected with the user’s bank and cards.

Here are other things you must know about e-wallets:

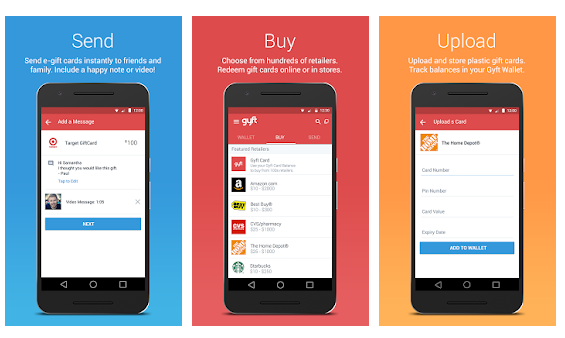

- You can use it to buy a wide range of products–from groceries to airline tickets, sans the need for a credit or debit card;

- It’s easy to use as you merely have to log in or register with shops that you frequent, provided that they have e-wallet as a mode of payment;

- The steps on how to use it will vary on the shops that enable this kind of payment portal. But even these are easy to understand and apply, even if you’re non-techy.

Types of E-wallet

1# SMS Based Payment

This Wallet uses the customer’s banking card information to make the payment where SMS containing code and password is being sent to the customers for confirmation.

The OTP i.e. One-time Password is being shared which is being used by the users to make the payment via their E-wallet.

2# Mobile Web Payment

Through Mobile Web payment the problem of entering card details, again and again, is solved. This Mobile money payment Solution provides two layers of authentication for the users to check-in i.e. via OTP and UPI pin.

3# Mobile Communication Service Provider

It is one of the most popular, secure, fast, convenient, and easy methods of doing Payment. As in this method, the user’s mobile account is used to make the payment.

4# QR Code Payment

This form of payment is famous at the Brick and Mortar store where the mobile camera is being used to scan the QR code then the payment is being made from the linked bank account.

5#ApplePay Or Apple Wallet

This is another type of e-wallet application that’s most commonly used because it’s available across Apple or iOS devices. In your Apple Wallet, you can keep anything from different modes of payment and even copies of your boarding pass, hotel accommodations, and whatnot.

4 Advantages of the E-Wallet System

Today the E-wallet system is being used by everyone who is fond of purchasing and selling things on the Internet. For them, the E-wallet system is the most beneficial and easy mode of payment.

The e-wallet system has various additional benefits that the common credit debit cards do not provide. Hence making the digital payment system the efficient and effective mode of payment. Below are some of the advantages

1# Simpler Payment Process

With an e-wallet, the customer can easily pay for the service or the product both online or in the physical store.

As the payment through plastic cards is a more complex process as one needs to enter the card number, CVV every time the transaction is being made.

2# Tenure

As compared to plastic cards e-wallet registered account user can use it for a long time as much he like.

3# Convenient For Freelancers

People who work as freelancers have their clients available online. Hence Receiving and paying electronic money via e-wallet is the most convenient mode for them.

Not only is this convenient for freelancers but it works well for anyone who also has to travel a lot. In case you’re in a place without an ATM machine nearby and there are certain transactions where you don’t want to use your credit card, your e-wallet is a very good alternative. You can still make payments in your supermarket run, for instance, even if you don’t have any physical local currency with you yet.

4# High Transaction Speed

Bank transfers sometimes take from several hours to a few business days. Transactions with electronic money are performed in a matter of minutes.

Extended payment functionality. Digital wallet features are:

- A highly protected user account with all the necessary information for making a secure e-wallet mobile payment;

- The ability to select the desired currency (ideally, the list should offer cryptocurrency either);

- The possibility of convenient funding of the e-wallet (or withdrawal of funds from it).

5# Safety

When compared with other forms of digital payments online, e-wallets are also one of the safest to use. This is because you can use your e-wallet to pay for goods and services, even without the need to input your credit or debit card details.

This safety advantage also applies to frequent travelers. Generally, using credit cards is the way to go, but this is not without disadvantages. Credit cards can also fall prey to fraud in outside countries. Then, there’s the unsafe option of bringing along large amounts of cash, which is dangerous as you’ll be prone to theft. E-wallets are great as you only have one device to think of keeping safe at all times: your mobile phone.

Factors To Keep in Mind While E-Wallet Software Development

Here are some key factors that you need to keep in mind during E-wallet software development;

1. Prioritizing The E-wallet Functions

As we know The e-Wallet application consists of various features and functions and to make your build money transfer app successful prioritizing them becomes a must.

Deep Market research needs to be done to analyze the customer’s demands and desire and compare it with the market trend before building up the application

2. Security

This is the most important feature of the digital payment system or the e-wallet application as the customers rely only on those applications which have a tight security structure as they need to share there all bank and card details.

Hence it becomes the primary responsibility of the developer to secure their data by using advanced technology methods and a secure payment infrastructure so that the data is hard to decrypt.

3. Digital Receipt

As soon as the transaction is being done by the customer they need to know and want a confirmation about the success or failure of the transaction.

Therefore issuing of digital receipts becomes a must. Either it can be shared with their registered mail address or can be built in the application only.

4. Reward Points

People love to get rewards or cash back. So if you want to make your digital payment application sustain in the market for a longer run.

Do start giving leverages in the form of rewards or cashback. These reward points can be redeemed later by the customer and would also help you to understand your target audience, their likes, and dislikes.

5. Keep Them Engaged

Sharing timely notifications with the customers from time to time would help you to keep them engaged in your e-wallet application.

They won’t abandon the application after its first usage if they would get timely notifications about the latest offers and discount on your e-wallet applications

Conclusion

Mobile wallets are no longer just a market trend but it has become the need of the time. But to enjoy the benefits of this fast-evolving e-wallet market, you need to ensure flawless implementation of various features on your application to engage your customers.

You May Like To Read:

- Get to Know Unique E-Wallet Apps and How They are Changing the Payment Landscape?

- Top 20 Bitcoin Wallets in 2021

- Top 5 App Development Platform for Small Business

Author Bio: Nikunj Gundaniya, Product manager Digipay.guru, one of the leading eWallet Application Development, which provides mobile finance application development services. He is a visionary leader whose flamboyant management style has given profitable results for the company. He believes in the mantra of giving 100% to his work.