Wyoming is one of the ideal states in US for LLC formation.

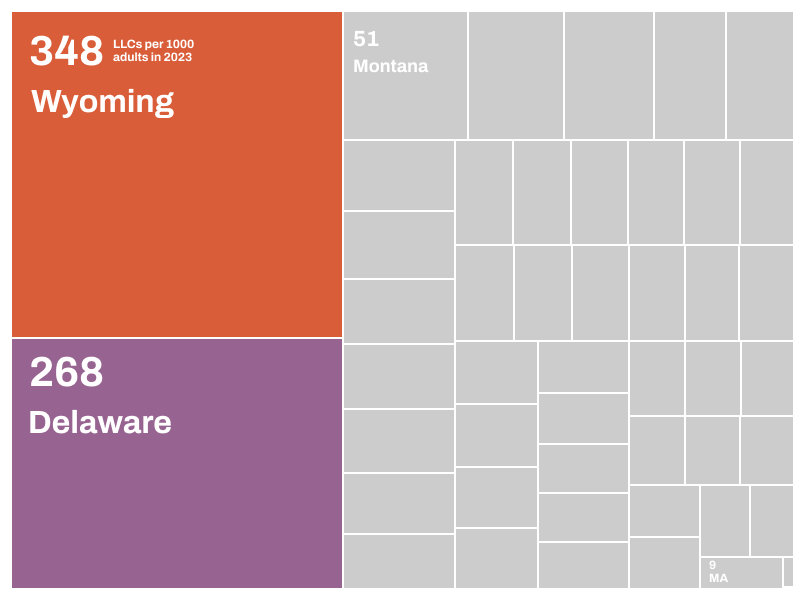

According to CowBoy State Daily, approximately 45,000 new companies were registered alone in 2023. That means 42% rise from previous year incorporations. In this regard, Wyoming overtakes Delaware for most per capita incorporations (LLCs per 1000 adults) in the country. Ana Muñoz Padrós and the OpenCorporates Insight Team suggests that this significant rise in LLC formation in Wyoming is due to asset protect laws.

If you are planning to register new LLC (a.k.a. Limited Liability Company) in United States, Wyoming would be an ideal state. There are several key benefits to register your limited liability company in Wyoming i.e.

- You will not need to pay state income taxes

- Best asset protection laws

- Asset protection and limited liability

- Members nor Managers are not listed with the state. This provides an extra privacy.

- No citizenship requirements. That means foreigners can easily register their LLCs.

- Perpetual life

- Transferability of ownership

- Ability to build credit & raise capital

- Number of owners is unlimited. Even only single member can create LLC.

- Lower startup costs.

Here are some basic guidelines and steps you need to follow to register your Wyoming LLC.

Form a Wyoming LLC – Step By Step Guide

1. Choose your LLC Name

If you are going to registered your limited liability company, you will need to name it. Your LLC name must be unique and comply with Wyoming’s name rules. Similarly, the name must include “LLC”, “L.L.C” or “Limited Liability Company”.

If you are wondering how to find, validate and availability of the name, you can visit Wyoming Secretary of State’s Business Name Search Tool.

2. Find and Appoint a Registered Agent

Once you finalize your LLC name, you will need find and appoint a registered agent in Wyoming. This is a compulsory requirement in Wyoming as per law. The registered agent will receive legal documents on behalf of the company.

The registered agent can be another person or a professional registered agent service. The cost of appointment of registered agent varies and typically starts from $25 and goes high depending up the services they are providing.

We have published a detailed blog on how to find a registered agent in Wyoming. Hopefully, it will be helpful for you to find the right one.

3. Prepare Legal Documents

After the appointment of registered agent, the second step to prepare your company formation documents.

i. File Articles of Association / Organization

You will need to craft your articles of association / organization and file with the Wyoming Secretary of State.

The Articles of Association shall include your;

- LLC Name

- Principal Office Address

- Registered Agent Details

- Organizer’s Information

Once you prepare your document for forming an LLC in Wyoming, you will need to file it. There are two options to file AOA. Either through online or through mail. If you opt online, you will need to pay $100. However, if you opt mail, you will need to pay $102.

ii. Creating an Operating Agreement (Optional)

Operation Agreement outlines how the LLC will operation. This document includes;

- Member roles and responsibilities

- Voting Rights

- Profit and loss distribution

- Dissolution procedures

It is important note that operating agreement is optional but recommend.

4. Obtain Your Employer Identification Number (EIN)

Once your registered agent incorporates your LLC and file the necessary documents with Wyoming Secretary of State, the next important step is to obtain Employer Identification Number (EIN).

EIN (Tax ID) is required, if you have employees or multiple members. Similarly, it is also important to obtain EIN because you will need to provide this to bank while opening your company bank account.

Both U.S residents and non-residents can get EIN. If you are U.S resident, you will get free EIN and you will not need to pay any government fee. The residents can apply online through IRS website (the fastest method) and also through fax / mail using form SS-4.

However, if you are a non-resident, you cannot apply through online IRS website. You will either apply through FAX sending Form SS-4 to +1-855-641-6935 (4 business days processing time) or through mail and send it to Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999, USA (4 weeks processing time).

If you face any delay in your EIN application, you can also reach out on the IRS helpline +1-267-941-1099 (Not Toll-Free number).

Non-residents usually apply for EIN through third party services (i.e., registered agents). And they typically charge from $50 to $300.

Note: You must provide your U.S address in your application for correspondence purpose. You can also use your registered agent address.

5. Obtain Wyoming Business Licenses & Permits

Some specific businesses require licenses and permits to operate in Wyoming. In this regard, you will need to visit Wyoming Business Council and determine if you need to obtain license or permit.

6. Open a Business Bank Account

The final step to open your company bank account. To open a bank account, you will need to provide KYC information and some primary documents to bank:

- SSN (For Residents) / ITIN or Passport (For Non-Residents)

- Email & US Telephone Number

- S Address (not Registered Agent Address)

- Employer Identification Number (EIN)

- Article of Organization

- Operating Agreement (Optional)

Once you complete the bank’s requirements, they will open the bank account.

Bingo, now you have followed all the steps and now able to form your Wyoming LLC.

Post Incorporation Compliances for Wyoming LLC

Each year by the first day of your LLC’s anniversary month, you will need to file annual reports with Wyoming Secretary of State. In this regard, you will need to pay $60 state fees along with registered agent fees.

It is pertinent to mention that U.S laws, regulations and banking requirements change from time to time. In this regard, you must coordinate with your registered agent to ensure your LLC remains compliant and in good standing.

Read Also:

- Guide on How to Find Registered Agent?

- 10 Best Wyoming Registered Agents

- How to Obtain ITIN As Non-Residents?