The cryptocurrency market saw about 11 billion USD wiped off its capitalization in the week to 24th February 2019. The net effect of this can be traced to the remarkable drop in the volume of Bitcoin trading on Binance and Coinbase.

The lingering bear run in the cryptocurrency market has seen a long reign over the past year with short bursts of the price surge.

However, amid the bad press and sometimes orchestrated attacks by deep-seated players in the global financial markets, the market has seen a curtailed ascension.

The Bitcoin Revolution

The height of the bitcoin revolution saw a surge in market volumes of trade across several crypto trading platforms from 2017 to 2018. However, the highs have crashed to an all-time low over the course of the second quarter of 2018 to date.

In the consideration of several factors that have contributed to a bottoming of Bitcoin trading volumes, there is perhaps no reason to look far off. The move of the US SEC to avoid taking an early decision on Bitcoin ETFs has put the market in a lull.

Many market watchers have pointed at the effect of bitcoin adoption across several layers of the financial scene that cannot be ignored. With Ripple cutting into the dominance of fiat in money transfers globally, entrenched interests have had to fight back.

The same can be said of Bitcoin with its wildfire effect across the globe as an alternate transaction enabler. Many people have taken to bitcoin to settle accounts of commercial transactions on a daily basis. Its near-instant send feature with the lightning network has given it more credibility.

One clear sign that bitcoin is sure to make a difference is the launch of new cryptocurrency apps. The evolution of apps and platforms that are geared towards speeding up bitcoin’s pace of transactions indicates the trust it commands in the marketplace.

The Bitcoin Trading Drop in Transaction Numbers

Bitcoin trading across cryptocurrency exchanges have been impacted by the dropping market price. The direct effect of this was the drop in January figures by up to 40 percent from the December 2018 numbers.

In examining the falling bitcoin volumes in the exchanges, what is evident is that many people seem to be holding out for a clear direction. While the utility of Bitcoin has not withered over time, the fact is that it still commands user attraction.

In the marketplace of transactions, many people are not able to read the trends and as a result, they respond to the hype. This makes them convert their bitcoin holdings to fiat or pause trading until a new direction emerges.

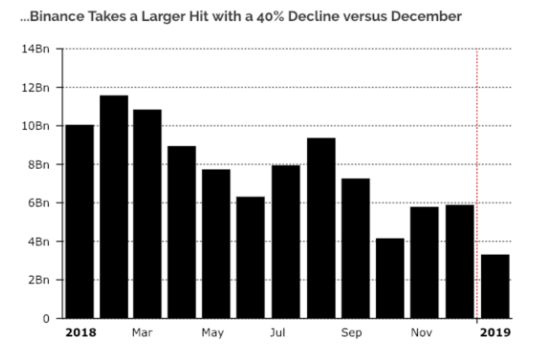

The Binance Volumes

The numbers from Binance exchange have not been encouraging in January 2018 versus January 2019 comparison. A huge 40 percent wipe off in trading volumes was recorded by the platform which stands out among the best cryptocurrency exchanges.

In 2018, Binance commanded an average daily bitcoin trading of about $1.2 billion and as of February 25, 2019, this has dropped to $235 million. Evidently, losing more than 80 percent of its peak transactional volumes cannot be overlooked. It is a clear sign of a tightening market condition.

While Bitcoin is just one of the tokens and coins traded by the exchange, there are a whole lot of hundreds of other cryptocurrencies on the platform. As many analysts have highlighted, the bandwagon effect evidenced by the crash of transactional volumes is traceable to Bitcoin.

When Binance started its early trading promotion, it caught the customer with low transaction fees. However, with the likelihood that the crypto rush has abated, the incentives have failed to push the daily transaction numbers.

Data for Binance Trading. Source: CoinAPI

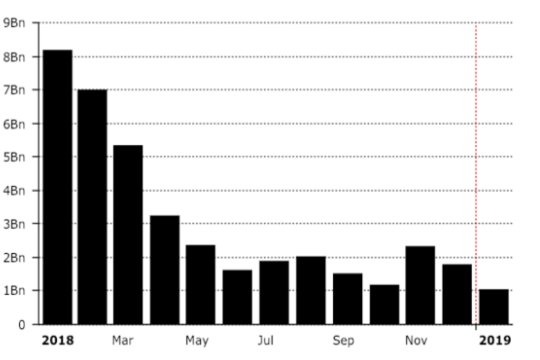

The Coinbase Volumes

In terms of transaction volumes, Coinbase is reputed for its more than 8 billion USD worth of daily takings as of 2018. However, this height has crashed to just $1 billion as of February 2019. Coinbase has enjoyed a reputation as the most trusted exchange by American and European traders.

However, as the volatility of Bitcoin prices turned largely negative, the market has seen a reversal that is vivid. Yet, the bulk of transactions on Coinbase has largely revolved around users who used fiat for cryptocurrency purchases. And for many people, Coinbase is still the first choice for such transactions.

As the fiat to BTC trades has largely floundered of late, there is no doubt that the effect was to be felt across the globe. The late surge in Litecoin values this February 2019 also gave a fillip to the transaction numbers here. A number of traders also made the needed moves to try to make the best of the LTC rise.

Despite the ray of hope presented by a few chart makers like LTC, there has been little to cheer about in the market.

Data for Coinbase Trading. Source: Diar

Without a thread of doubt, there is every reason to recognize that as the volatility of market price got stifled, fewer transactions were recorded.

What about the other Exchanges?

Apart from Binance and Coinbase, other exchanges have also risen to global prominence in terms of transaction volumes. We can now briefly see the top picks:

1. Bitmex Exchange

Of late, Bitmex exchange has become a chart-topper as a result of its leveraging functionality. The user here is able to use the leveraging options to trade and profit from price movements. As of February 25, 2019, the daily trade volume peaked at $2 .2 billion and this is still remarkable.

On the chart of the top 100 exchanges, Bitmex 7-day volume peaked at $4 billion while the 30-day volume was $26 billion. It was reported that the annual volume on Bitmex to 2018 year-end was about $116 billion in real terms. However, since the leverage is 8.6x on this platform, its notional turnover comes to over $1 trillion.

As a leading margin trading base, Bitmex Signals can be said to be a major bitcoin trading platform globally. So, even in a bear market, profit seekers are still able to use bitcoin for profitable trading. With its full disclosure policy, Bitmex can be said to be a host to huge bitcoin transactions.

2. OKEx Exchange

This cryptocurrency exchange recorded huge volumes in 2018 and became the fastest growing platform. Its monthly volumes were topping the $4 billion mark all through November 2018 to January 2019 till it fell off as February approached.

Despite the raging of the bulls, the 24-hour volume in OKEx is now about $1.4 billion and this is still remarkable.

3. Looking Ahead

Why a bear market surely comes with a mixed grill of emotions and effect on the psyche of traders, it also presents some openings. Binance in recent weeks announced that it has launched support for fiat transactions so that credit card payments are enabled.

While some people might wonder why Binance changed its vaunted fiat to fiat conversion policy, the motivation is not far-fetched. It is evident that the market realities required this move as steps needed to be taken to ensure that it maintains its market share.

Since it is clear that the crypto trader is concerned about savings in a clime of falling prices, whatever can help the trader is commendable. In terms of convenience, the Binance move is laudable and it might lead to the platform winning over some traders.

Conclusion

As we go further into 2019, the marketplace realities will surely determine how bitcoin trading grows or stymies. What is clear is that just like stock exchanges, bear markets do not last forever, and the crypto investor can anticipate the next bull run just yet.

Read More:

- Top 20 Bitcoin Wallets in 2019

- 5 Major Risks in Bitcoin Market

- Crypto Bots: A Beginner’s Guide to Cryptocurrency Trading Tools

Author Bio: Denise Quirk is a Health Advisor who is fascinated by Crypto and Blockchain Revolution. She is a believer of transforming complex information into simple, actionable content. She is keenly interested in finding the value of the crypto world. You can find her on Linkedin, Twitter and Facebook.