Everyone strives hard to ensure future security of their loved ones. You too must be putting in endless efforts for the quality education of your children, their higher studies, marriage etc.

Future Generali Flexi Online Term Plan / Insurance assures you about the security of the future of your family and fulfillment of their daily needs when you are absent.

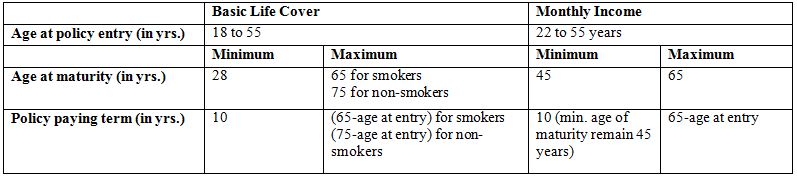

A range of online term insurance plans allow you to choose one that suits the best to you, based on your eligibility. One of the plans is given below with its comprehensive details:

Future Generali Flexi Online Term Plan

This term life insurance plan offers you a basic life cover with a benefit of sum insured as a lump-sum payout.

This plan offers a fixed monthly income over a period of 10 years or till the age of 60 years, whichever period is higher. While purchasing this plan, you can choose between the benefits from a fixed monthly income or an increasing monthly income along with the basic life cover.

1). General Benefits

- Long life coverage till the age of 75 years

- Discounted premium rates for female customers

- Discounted premiums rate for a high sum insured

- Tax benefit u/s 80C, 80 CCC, 10 (10D), and 80D of ITA, 1961

2). Policy Period

- The policy comes with a free look period of 30 days and you can return it within the same period along with your objection stated, in case you have an objection with any of its terms and conditions. The premium paid will be refunded to you after some nominal deductions, viz. charges of stamp duty, medical test fee and so on.

- The policy provides you with a grace period of 30 days for premium payment while in the meantime you stay insured and entitle to receive the death benefits as mentioned in the documents after a fair deduction of premium amount, which is due.

3). Death Benefit

The death benefit will be the higher of

- An amount equal to 10 times the annualized premium (taxes and additional premiums remain excluded), or

- An amount equal to 105 percent of total premiums (taxes and additional premiums remain excluded) paid (as on death), or

- The sum insured

4). Eligibility Criteria

Related: Business Life Insurance advice for Small Business Owners

5). Policy Exclusions

- The policy stands void if your death is a result of any self-harming act (such as suicide) in the first year after the date of inception. And, an amount equal to 80 percent of the total sum insured will be returned to the nominee after the death.

- The policy stands cancelled if your death is a result of any self-harming act (such as suicide) in the first year after the date of revival. And, an amount equal to 80 percent of the total sum insured will be returned to the nominee after the death.

6). Policy Disclaimers

- The policy shall lapse if the premium remains unpaid after the end of the grace period of 30 days and no coverage will be offered during that period.

- Once lapsed, the policy can be revived within 24 months from the date on which the last premium is pending.

- Failure of the above results in termination of the policy for no value.

Future Generali Life Insurance powers you secure the future of your spouse and children with an affordable annual payment of the policy premium. Get your plan today!