Preparing and filing for income tax record can be a challenging for some people if they don’t know how income tax works in the country.

There’s no doubt about it; the number of UK businesses and entrepreneurs working abroad has increased markedly over the last few years. In fact, this number peaked at 235,800 in 2017, having grown by 6.6% on the previous years’ figures.

However, it’s fair to say that some destinations are more popular than others amongst Brits, with fellow EU member states offering obvious advantages to expats.

Malaysia is also an increasingly popular destination for entrepreneurs, although operating in a location that so different to the UK in terms of culture provides a clear challenge.

In this post, we’ll help you to understand the taxation rules facing entrepreneurs and business owners in Malaysia, whilst asking why this is so important.

Tax in Malaysia – The Basic Rules of Malaysia Tax

Any individual earning more than RM34,000 annually (RM2,833.33 per month) deductions has to register a tax file in Malaysia.

There is a tax requirement on all types of income, including income from your business or profession, employment, dividends, interest, discounts, rent, royalties, premiums, pensions, annuities, and others.

In general terms, the Malaysian authorities use both progressive and flat rate for personal income tax, depending on your earnings and the amount of time that you’ve worked in the country as an entrepreneur. Following are guidelines for foreigners staying in Malaysia.

- There will be no tax incentives if you stay in Malaysia for less than 182 days.

- Tax rate will be 0-28% for persons staying in Malaysia for more than 182 days and flat 28% for those who are living for less than 182 days.

- Once all your tax reliefs have been claimed, your chargeable income determined, and your tax rate and amount decided, you can claim for any tax rebates you are eligible for. Zakat and Fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount.

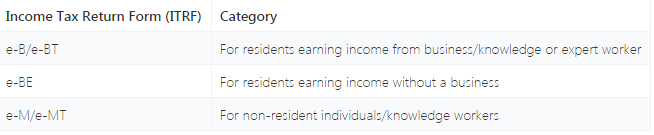

For non-residents of Malaysia, before filing for online taxes there is a requirement for registering as a tax-payer on e-Daftar to get ITN and getting PIN number from nearest LHDN branch. This PIN number will be used to log-in to ezHASIL website.

This is based largely on the Income Tax Act of 1967, which structures personal income taxation in Malaysia based on the government’s annual budget and a host of other variables.

You should also note that this personal income taxation differs from corporate tax, which is currently fixed a rate of 24% and is expected to remain at this level throughout 2020.

Tax Residency Status – The Key Considerations

As an expat business-owner, your tax liabilities and obligations will depend largely on the period of time that you’ve been working in Malaysia.

For example, if you’ve worked in the country for less than 60 days, you’re formally exempt from having to file out tax returns or pay a share of your income.

If you’ve lived and worked in Malaysia for a period of between 60 and 182 days, you’ll be officially classed as a ‘non-resident’ and charged at a flat taxation rate of 28%. You’ll also be ineligible for any tax deductions for the tax year, which has a significant impact on the total sum payable during this period.

However, if you’ve ran your business in Malaysia for more than 182 days then you’ll be classed as a ‘tax resident’. This means that you’ll pay progressive and changeable tax rates that are set by the government of the time, whilst also having the opportunity to become eligible for crucial tax deductions.

The Taxation Principle and its Exceptions

As we’ve already said, expats who have worked in Malaysia for less than 60 days won’t be eligible to file tax returns or pay income tax.

However, this is virtually the only exemption that the government has made with regards to taxation, although the nation has adopted a territorial principles of operation in this respect.

This means that only incomes that have a source in Malaysia are taxable there, so any profits generated from international markets may not be included in your tax returns.

This is where the rules can become a little complex, however, so it’s worth liaising with an international tax expert such as RSM Global.

After all, this will afford you peace of mind as an expat entrepreneur, whilst also ensuring that you pay the precise amount of tax that you owe.

Read Also:

- Ready to File? Here Are the 8 Best Tax Preparation Software Options

- 5 Tax-saving Hacks For Small-business Owners

- 5 Tax Deductions Indian Entrepreneurs Should Take Advantage Of This Tax Season

- 16 Profitable Small Business Ideas in Malaysia

Author: Anees Saddiq