In 2008, when the first time I used the credit card, I hoped one day I can do payment with my mobile phone. I am sure, lots of other people were burning under the same desire as carrying a ‘precious’ physical object, called, a credit card is stressful sometimes.

Additionally, People didn’t want to share their credit card details everywhere they pay. They wanted a single platform where all their banking details remain stored and whenever they need to pay, that platform allows quick checkout without sharing credit card details to the merchant. These urgencies were calling for swift action and thus, E-wallet came in the market.

E-wallet gives mobile app solution to the users. A user can add money into mobile apps through banks and credit cards, and whenever they need to pay someone, they can perform payment with few clicks on their mobile.

The Popularity of the E-Wallet Apps And Reasons Behind it

The first concept of E-wallet was launched by company PayPal in 1997. But it is extreme to say that PayPal was offering a complete E-wallet experience.

PayPal was an online money transfer platform where the sender needs to pay some percentage of the transferred amount to the PayPal company. While the business model of E-wallet is based on a commission-free model.

Though PayPal wasn’t offering complete E-wallet experience, people have adopted it widely and with this, the foundation of the E-wallets was deployed. But it took around 10 years to tech companies to offer a robust E-wallet experience.

With the launch of Google wallet in 2011, people got their first E-wallet. After two years, Apple also launched its own apple pay.

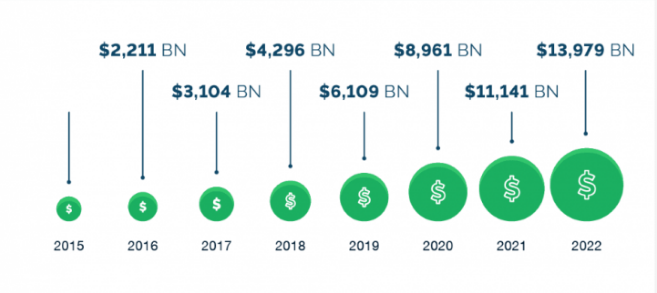

After these two launches, a storm of a new type of payment method hit the world. Currently, E-wallet market size is $6000 billion and it is expected to go up to $14000 billion by the end of 2022.

Reasons behind these much of the popularity of E-wallets apps are very obvious. It has the problem-solving ability and actually solving some of the major problems related to finance.

1# It is Fintech, yet easy to use!

Generally, any task related to finance is counted as a tough task. But E-wallet is giving a smooth and easy experience to the users.

Like any other apps, users just have to install the app and perform the signing process. Once they are signed in, they need to link the app with the bank or the credit card details.

With this, users are ready to use E-wallet whenever they want. When it comes to doing payment, different E-wallets come with different payment methods. One can simply use the QR code, phone number, email address or bank details to transfer the money.

2# Money related things need to be Safe and secure, period!

For instance, let’s compare the credit card payment method with the E-wallet. In the credit card, a unique pin is the only security feature.

But in the mobile wallet, one can secure his E-wallet with the biometric capability of his phone. Additionally, when a user pays from the E-wallet, the merchant gets the data of the E-wallet provider company, not the data of the customer.

This is how users’ precious data is safe within the app itself. E-wallet apps are more secured with advanced firewalls and encryption methods. According to VISA, 63% of fraud has been reduced with the E-wallets.

3# Anytime, anywhere!

This advantage of the e-wallet apps is nested with previously discussed advantages. Since E-wallets are easy to use and using it is very secured, more merchants are integrating it in their payment method.

Currently, all major E-commerce sites allow their customers to do quick checkout by paying through E-wallets.

People also prefer E-wallet apps to do payment on E-commerce site, due to the reasons we have discussed. With these two sides expansion, E-wallets are gaining popularity like never before.

Few Unique E-Wallet Apps with One Extra Feature Than Typical E-Wallet Apps

1. Skrill

Skrill is one of the features packed mobile wallets, developed by PlaySafe company which is highly active in providing finance solution to E-commerce websites and even brick mortar stores.

Further, Skrill app has a very clean UI which makes easy for users to understand more features of the app. The major feature they are targeting is the international money transfer from the app.

As of now, they support 40 types of currencies and giving the ability to send and receive money in 180 countries.

Other features include:

- It allows the user to add fund into an app from the bank, credit card and debit card.

- In order to send money to the other person, sender just needs to add Email of the receiver.

- Skrill claims that the transfer fee for international transfer is very low.

- It also offers the easy payment method to other services and sites like Netflix, Skype, Stream and other. The user can also use the fund of the Skrill app in poker rooms and casinos.

- One of the best and trending features of the Skrill is, by using the app, the user can buy and sell cryptocurrency.

- Through the app, the user can claim the Skrill prepaid Mastercard to withdraw cash from the ATMs.

How is this tiny app changing the Payment landscape?

Skrill is the first mobile wallet which offers the option to buy and sell cryptocurrency with the mobile wallet.

2. Gyft

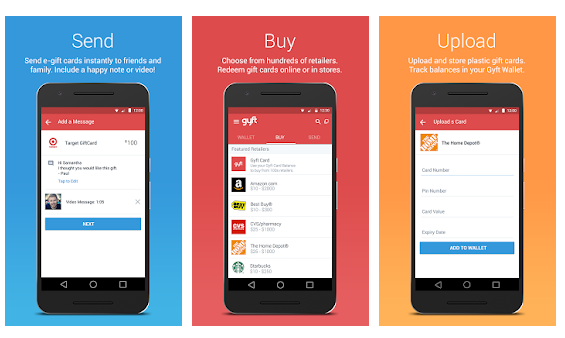

Gyft app is the successful try done by Gyft Inc. to expand the boundaries of the E-wallets. E-wallet should not be limited to only money, but it should also cover the different kind of digital products which can be saved into E-wallet.

Unlike other E-wallet apps, Gyft doesn’t mean for sending money to friends and merchants, but Gyft lets users send different gift cards to anyone. Gyft app has the list of retailers which have listed out gift cards to buy and send.

The user can buy his desired gift card by paying through credit and debit card and sends it to his loved one. A user can also save his bought gift card in the app. This is how the major concept of this app is to transfer the money in the form of gift cards.

How is the Gyft app changing the finance platform?

Gyft is not a complete E-wallet app, but it shows that how an E-wallet app should work like. With the Gyft app, the over-generalized belief of the people related E-wallets has broken down.

Now, people are expecting not only digital fund transfer revolution but a digital product transfer revolution too.

3. Payit- a finance service for citizen and government

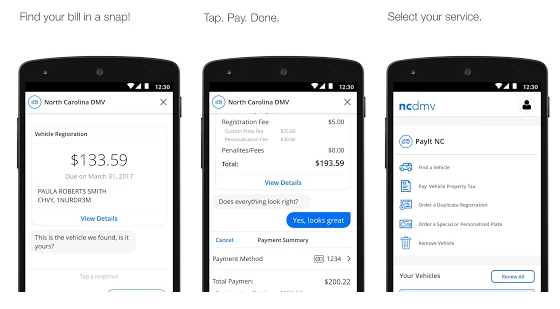

Payit is the USA based company which are providing a digital solution for different government services like vehicles registration, taxes, professional licensing and tolling.

Basically, Payit provides an administration tool to the government for different government services and gives an app to the users to perform that government activity without standing in the queue.

All product of the Payit works on cloud-based technology and payit claims that the platform is secured. Payit also gives advanced analytic functions to the government that helps them to enable more efficiency.

The government of North Carolina has adopted Payit solution for the vehicle registration. A team of the Payit has set up an administrator system in the Department of the motor vehicle and developed an app for the users.

This app named, myNCDMV lets users renew the vehicle registration with the few clicks on the mobile phone. Through the app, a user can pay for the vehicle registration, ask for the duplicate registration, and order personal number plates. This app also has a storage option. A user can store his documents in the app itself for future use.

How Payit is changing the payment platform?

Payit is bringing the government and the citizens under the same digital platform. Using Payit, the government can create an online platform where citizens can utilize the services and pay the charges of that services with the app.

Payit is not only providing E-wallet but providing the complete online solution of the government services with admin tools.

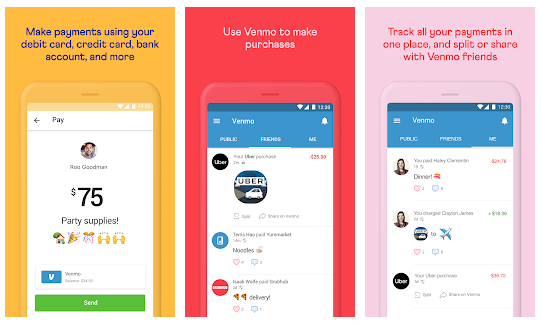

4. Venmo

Venmo is the mobile wallet but with the one very important extra feature. This app has the social aspect, that means, you can actually make friends in it and share your regular activity with them.

One more thing you can share with your friends is money. Further, Venmo lets you add the money from the bank into the app. Through the app, you can send money to your friend.

You can also pay for your e-commerce purchases and to different merchants. As of April 2019, Venmo hit almost 200,000 downloads with an average rating of 4.6 stars. According to the data of Google PlayStore, it ranks 2 in the app category of Finance.

How Venmo is changing the payment platform?

Venmo is bringing the social aspect in the E-wallet that means people can exchange money with their friends more easily.

After knowing the brighter side of mobile wallets, let’s quickly check out how it will affect the world in the coming years.

Future of Mobile Wallet Apps

- Paying through mobile without even unlocking it will be possible with the advanced NFC and biometric sensors.

- Not only through mobile, but it will also be possible to do payment with the wearable devices.

- E-Wallet apps will offer banks like functions, including insurance, loans, and credit cards.

- Other forms of digital assets will also be possible to transfer through the mobile app.

- E-wallets will be the top secured medium of storing and transferring funds.

In the Nutshell

There is no point to do argue on the potential of mobile wallets. When the first time I used it, I remembered the time when I wished to do payment with the mobile. That time I wasn’t expecting that the mobile wallets will take over the whole payment landscape. But it actually happens.

Thanks to advance mobile app development technologies and market demand, E-wallet app development becomes so versatile. But we are not done yet.

We are still experiencing E-wallets apps with a few targeted features. In order to convert all people towards the E-wallets, we need to build such kind of app that enables sharing of all digital assets of the 21st century as money doesn’t remain the only asset nowadays.

Read More:

Author Bio: Vishal Virani is a Founder and CEO of Coruscate Solutions, a leading mobile app development company. He enjoys writing about the vital role of mobile apps for different industries, custom web development, online marketing, and the latest technology trends.