When one is low on cash, a simple way to get past your hard time is to take a loan; a short-time cash loan will help people with money difficulties.

Each year, over 10 million Americans take cash advance loans such as Payday loans. But one wants to keep one’s credit report intact. One does not want to lose credit points by taking a cash loan.

So, let us make sure this does not happen. In this article, you will read about the factors that affect the credit rating and how one may take a short-term loan or cash advance.

Need For a Cash Advance

Many people face a situation when a temporary loan is helpful. Your car might break down when there is no cash balance left in your bank account.

You might need cash to carry out repairs for your refrigerator or pay the installment for your child’s tuition fees. Or, you might need it to cater to an out-of-town guest who has dropped in for the weekend.

You need not worry because the Payday loan is always available for every person with a job. Temporary loans up to $1000 will get credited to your bank account the moment your loan gets sanctioned. All one has to do is to submit the application form for the loan.

You can borrow on your credit card, but what if they have locked your credit until you have paid all outstanding dues? And what about a bank loan?

Well, here you have to wait for two weeks at least after you apply for the loan. And you have to show enough balance in your account before they approve the loan.

What is a Cash Advance?

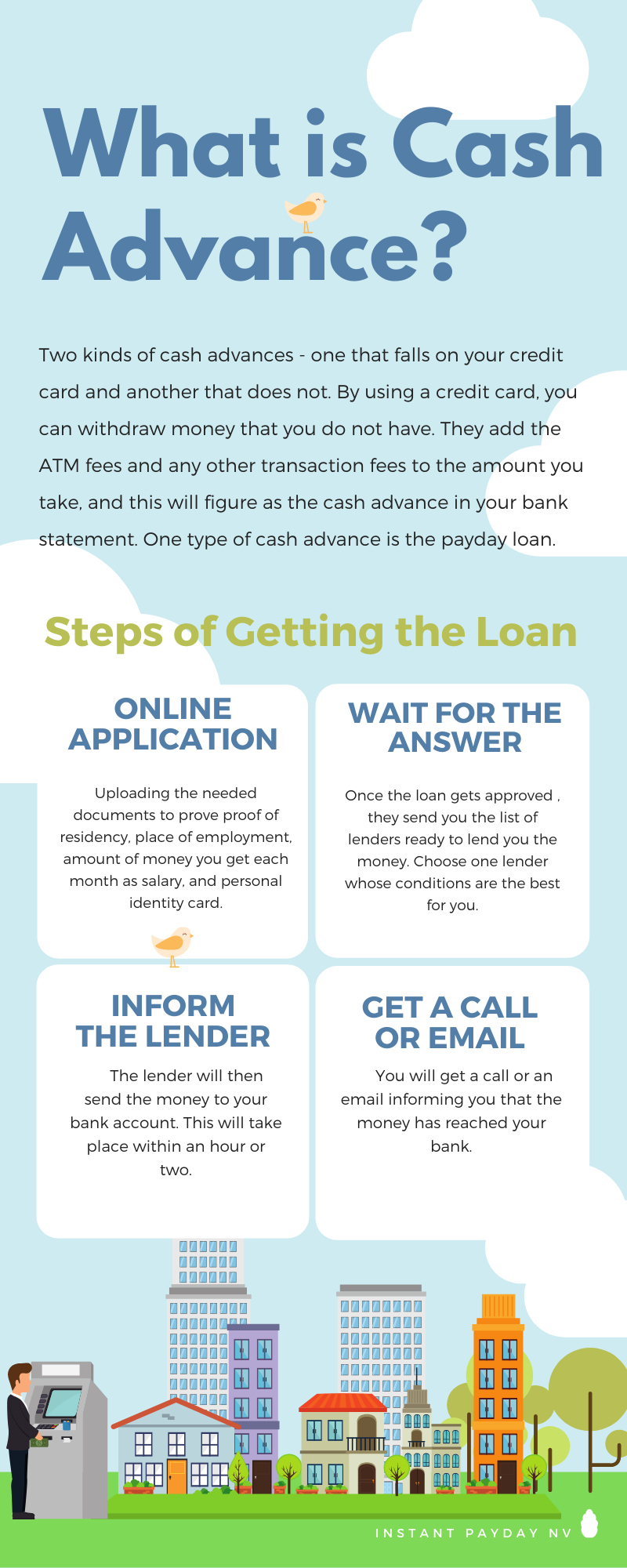

There are two kinds of cash advances – one that falls on your credit card and another that does not. By using a credit card, you can withdraw money that you do not have. They add the ATM fees and any other transaction fees to the amount you take, and this will figure as the cash advance in your bank statement.

One type of cash advance is the payday loan. Online payday loans Nevada is the service provider through whom you get the loan. But note that they do not lend money. They connect the borrower to their network of lenders.

You get the loan from the lender you select from the list given to you by the service provider. This cash advance (loan) will affect the credit rating (or not) depending on the amount of money you have already borrowed and the amount of money present in your account at the bank.

Difference between the two

Cash advances remain different from credit card transactions in a few key ways. The first is that the APR is much higher for the cash advance than that for the credit card transaction.

And the second most significant factor is that there is no 30-day grace period. The interest begins immediately and goes on accumulating until you have repaid the entire amount.

The borrower of the cash advance will repay the amount within two weeks, which is when the person receives his paycheck. The entire loan gets repaid as one lump sum amount.

What is the Impact of a Cash Advance on Credit?

The cash advance goes by another name – no credit check loan. But there is a bad connotation to it because there is no credit check made when you take the loan. No credit information will go to the credit bureaus, since the credit lenders do not have to run their credit checks on you.

Regular lenders such as financial institutions and banks will run a hard credit check on you. Real people will check the transaction and make hard copies of it. These hard checks will figure in your credit rating and there will be a copy on the report itself.

The APR is high and can reach as much as 300%. You must pay the amount in a short time, meaning you will have no cash in hand after you pay up the amount due. This will go on record as nil balance due to which your credit rating will drop.

This means borrowing money to cover your existing loan is not such a good idea. Your credit will improve only when you earn money and deposit it in your bank account.

Will the Credit Card Cash Advance Show on Your Credit Report?

The simple answer to this question is yes. Any time you add or remove money, it shows on your credit report. It is the record of how much money is in the bank and how soon you are spending it.

The cash credit advance will show up alongside your cash balance. But it will only have the importance of any regular cash transaction, and though it can have a negative influence on your credit, in most probability, it will not.

Keep your debts low

Keep your credit card balances low relative to your total credit limit. This is even if you pay everything you owe each month. If you keep your debt to credit ratio below 30%, it is likely that your balances will not affect your credit in the wrong way.

When your credit balances are above 30%, the cash advance will cause a negative impact. Or a massive increase in the amount owed could cause a negative impact.

Unless you are taking out thousands of dollars of cash advance or way above the 30% credit ratio, the cash advance will not affect your credit rating.

Get a Payday Loan

You can get a Payday loan within 24 hours by following a few simple steps. First, qualify for these conditions:

- You are 18 years of age and a citizen of the United States of America.

- The job you have must pay you at least $1000 each month. And you work at this place for the past three months at least.

- There is a valid bank account in your name to which they can send the loan amount.

- Details such as the employer’s name, place where you stay, bank account number, and social security number are a must.

Method of Getting the Loan

It is simple to get a loan. Follow this method to get the 24 hours payday Loans Nevada:

- Sending an online application; uploading the needed documents to prove proof of residency, place of employment, amount of money you get each month as salary, and personal identity card. You needn’t leave your house to get the loan; they will send it straight to your bank account. You will need access to the internet, any handheld device such as a smartphone or a desktop that gets you to the website of the service provider is enough.

- Wait for the answer from the service provider Payday Loans, Nevada. Once the loan gets approved (there are very few instances of a loan application getting rejected), they send you the list of lenders ready to lend you the money. You, as the borrower, must choose one lender whose conditions are the best for you. Send this answer back to the service provider.

- The service provider will inform the lender you have chosen him. The lender will then send the money to your bank account. This will take place within an hour or two.

- You will get a call or an email informing you that the money has reached your bank.

Now, you can withdraw the money and use it for the purpose you have in mind. You do not have to worry about the credit rating because the cash advance is not likely to influence your credit score.

Choose the cash advance loan from the proper service provider. Pick a reliable agency such as Payday loans NV for your loan and you will not face any difficulties. Make sure you pay back the loan in time and your credit will not suffer.

Read Also:

- How Can You Obtain a No Credit Check Loan?

- What Are The Benefits Of Instant Online Loans

- 3 Benefits of Merchant Cash Advances For Small Businesses

Author Bio:

My name is Branden Whittington. I am Content Co-Ordinator at InstantPaydayNV. Instant Payday NV helps you to provide online payday loans Nevada and get money instantly. Creating appealing contents to engage the readers all around the world is the author’s keen desire.